Cambridge, UK, is globally recognised for its leadership in life sciences and biotech innovation. But within this renowned cluster, one area has become a powerhouse in its own right: South Cambridge. With its concentration of cutting-edge research facilities, global pharmaceutical headquarters, and an expanding network of startups, South Cambridge is at the heart of a life sciences boom — and it’s attracting record levels of venture capital (VC) funding as a result.

South Cambridge: The Epicentre of Biotech Innovation

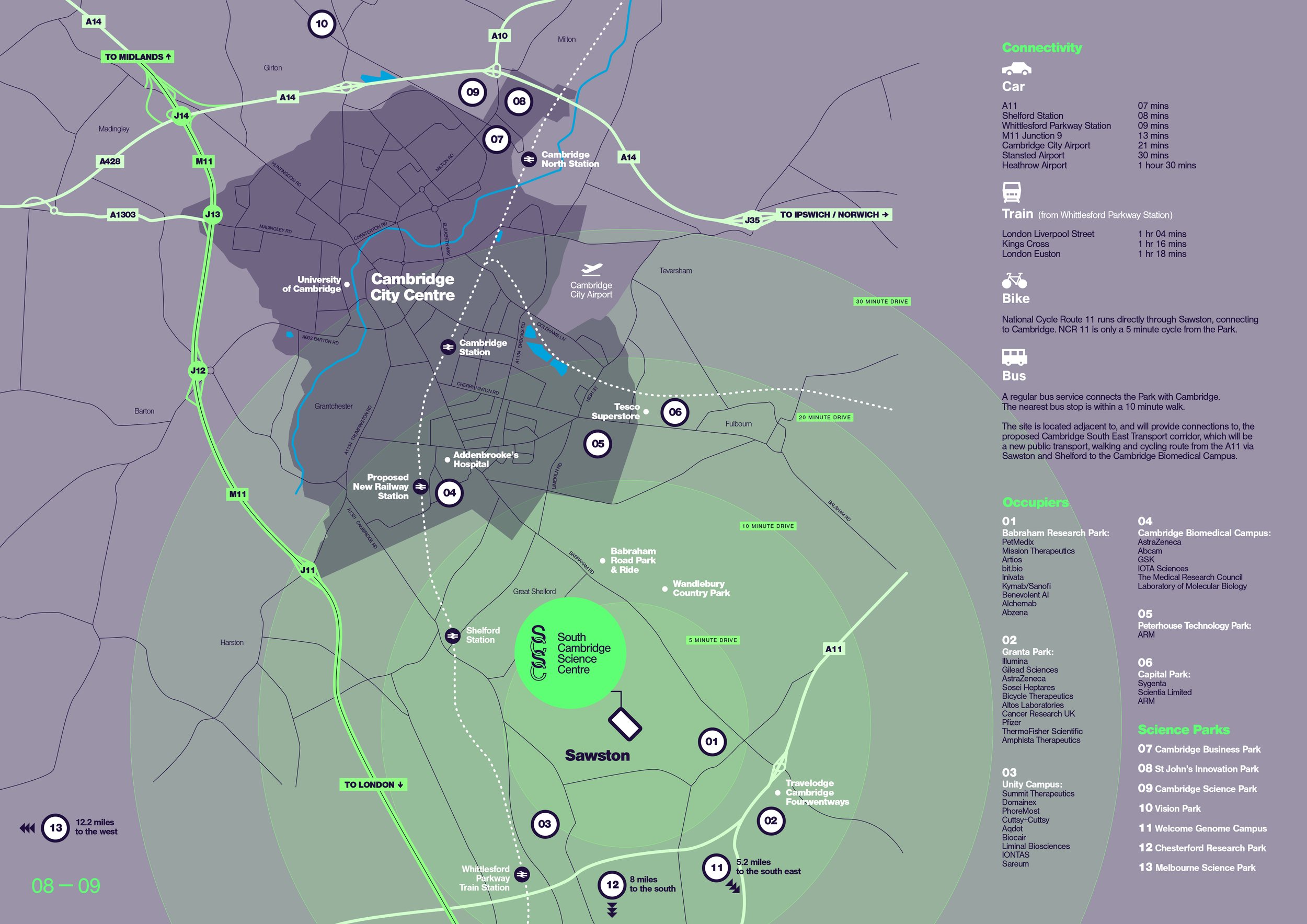

South Cambridge is home to the Cambridge Biomedical Campus (CBC). The CBC is the largest medical research and healthcare cluster in Europe. This innovation district includes the University of Cambridge’s clinical research departments, Addenbrooke’s Hospital, the MRC Laboratory of Molecular Biology, the Royal Papworth Hospital, and global R&D centres like AstraZeneca’s £1 billion headquarters.

The proximity of research institutions, hospitals, startups, and corporate giants creates an unparalleled collaborative environment for life sciences. It's in this high-density innovation zone that next generation biotech breakthroughs are being discovered. The science ranges from advanced diagnostics and genomics to therapeutics and digital health solutions.

Venture Capital Follows the Science

Over the past decade, South Cambridge has become a magnet for venture capital. In 2023 alone, Cambridge-based life sciences companies raised over £900 million, with a significant portion coming from ventures located in or near South Cambridge.

The area's unique mix of early-stage startups, established scaleups, and academic spinouts makes it highly attractive to investors. VC firms are drawn not just to the science, but to the infrastructure and support ecosystem that South Cambridge offers:

Specialised lab and office spaces

Direct access to hospitals and clinical trials

World-class academic partnerships

A concentration of experienced entrepreneurs and scientists

Key Players Fuelling the Investment Boom

Several leading venture capital firms have made South Cambridge a focal point of their investment strategies:

Cambridge Innovation Capital (CIC) – Based in Cambridge, CIC has invested heavily in life sciences startups across South Cambridge, particularly in digital health, therapeutics, and genomics.

Abingworth – A long-term backer of biotech, Abingworth has funded multiple South Cambridge companies through seed, Series A, and growth stages.

SV Health Investors – One of Europe’s most active biotech investors, SV Health continues to support ventures emerging from the South Cambridge cluster.

Amadeus Capital Partners – Known for backing deep tech and healthtech, Amadeus has turned its attention increasingly toward South Cambridge's booming sector.

These firms and others are providing capital and also playing a hands-on role in mentoring founders, shaping strategy, and guiding companies toward global scale.

Infrastructure That Encourages Investment

One of the major reasons venture capitalists are so attracted to South Cambridge is the quality of infrastructure. With the Cambridge Biomedical Campus expanding rapidly, the area continues to add:

New purpose-built laboratories

Flexible growth space for scaleups

Coworking and incubator programmes tailored for biotech

Direct transport links to London and Europe

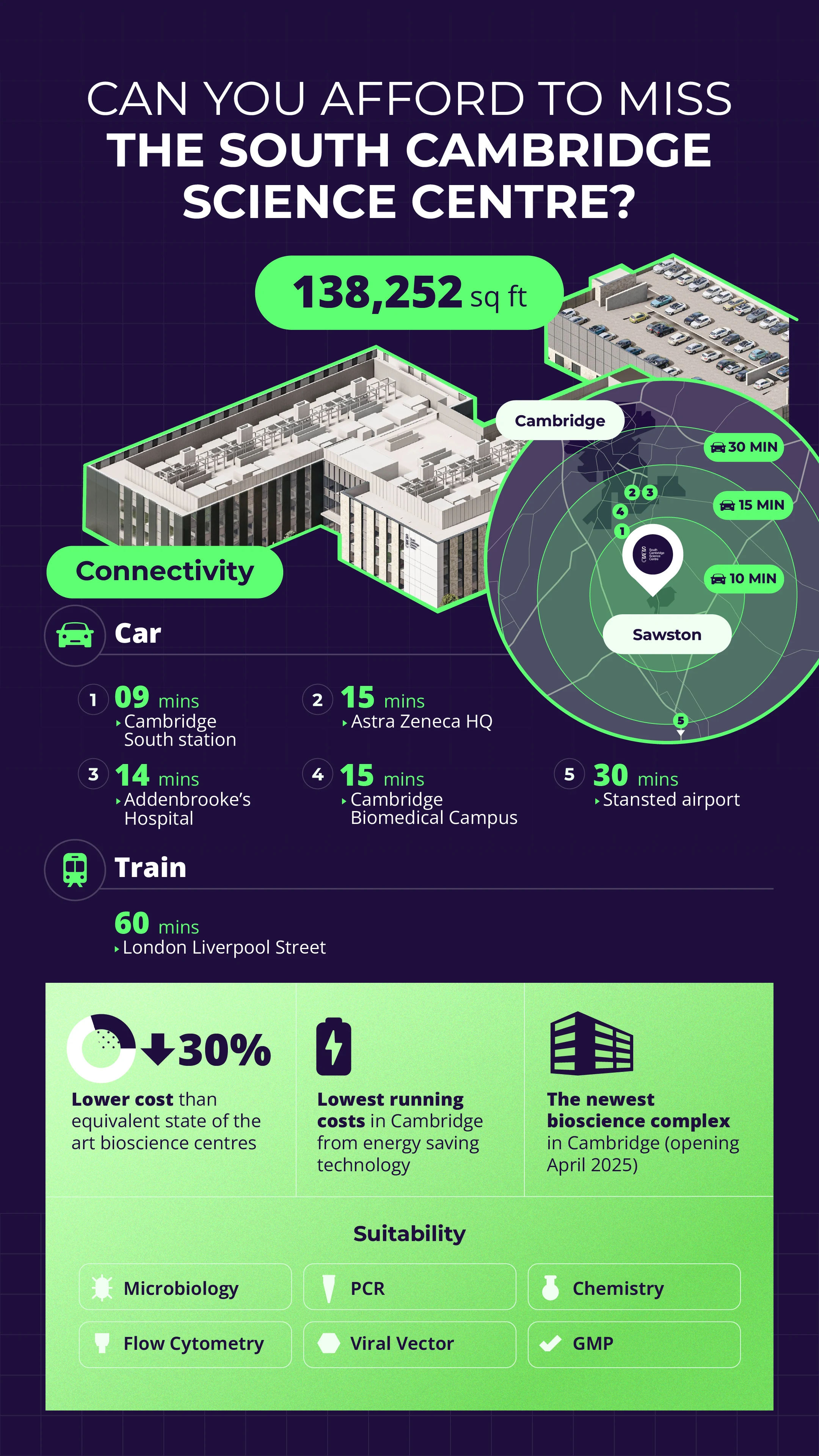

State of the art Science parks like the South Cambridge Science Centre which is a 10-minute drive to the CBC and adjacent Unity Campus and Granta Park provide companies with everything from wet and dry labs to shared equipment and meeting spaces. This makes it easier for startups to hit the ground running and attract serious investment. The South Cambridge Science Centre also offers rents 30% below market which is attractive to venture capital.

South Cambridge Success Stories

The numbers speak for themselves. Some of the most successful life sciences companies in the UK have emerged from South Cambridge, securing hundreds of millions in venture capital:

Artios Pharma – Developing DNA damage response therapeutics, Artios raised over $180 million with support from Andera Partners, SV Health, and Novartis Ventures.

Microbiotica – A microbiome therapeutics startup spun out of the Wellcome Sanger Institute, Microbiotica raised £50 million in Series B funding in 2022.

Congenica – Specialising in genomic interpretation software, Congenica has attracted over £50 million in VC backing and works closely with the NHS Genomic Medicine Service.

These companies, and many others like them, have chosen South Cambridge not just for location, but for the access to clinical networks, talent, and capital.

A Future Built on Venture Capital and Discovery

Looking ahead, the future of South Cambridge as a VC hotspot for life sciences looks brighter than ever. Several key trends are driving this momentum:

1. New Growth-Stage Investment Funds

Cambridge Innovation Capital launched a £100 million Opportunity Fund in 2025, aimed at filling the "scale-up gap" for life sciences and deep tech startups. This fund focuses specifically on later-stage companies, many of which are based in South Cambridge, allowing them to stay local rather than seek US-based capital.

2. Horizon Europe Re-Entry

The UK’s rejoining of the EU’s Horizon Europe programme has opened new funding streams and collaboration opportunities. Companies based in South Cambridge are well-positioned to tap into this pan-European network of grants and partnerships.

3. Sustainability and Impact Investing

More VC firms are seeking impact-driven life sciences ventures that address global health challenges. South Cambridge startups focused on infectious diseases, rare conditions, and healthcare equity are now front and centre in many portfolios.

4. Expansion of the Biomedical Campus

Ongoing expansion at the Cambridge Biomedical Campus will add thousands of square metres of lab space, creating even more opportunities for startups and scaleups to grow within South Cambridge. This expansion is being closely monitored and often co-funded by venture capital firms looking to secure early access to promising tenants.

5. The Innovate Cambridge Blueprint

Launched in 2024, the Innovate Cambridge strategy aims to double the region’s rate of unicorn creation and VC investment over the next 10 years. South Cambridge is central to this vision, with tailored initiatives focused on life sciences acceleration and investor engagement.

Conclusion: South Cambridge as the Heart of UK Life Sciences Investment

South Cambridge is not just a cluster, it’s the engine room of the UK’s life sciences economy. Through a combination of world-class research, accessible clinical networks, top-tier infrastructure, and increasing venture capital support, it has created a uniquely powerful environment for innovation and investment.

For startups, South Cambridge offers everything needed to scale from seed to IPO. For investors, it provides a pipeline of high-quality, science-backed opportunities. As venture capital continues to surge into Cambridge’s biotech scene, South Cambridge will remain at the centre, pioneering the next wave of innovation.